2022 is a period of volatility

Aluminum prices will see wild swings in 2022 due to the Russia-Ukraine conflict, logistical issues, growing recession fears and the COVID-19 pandemic.

Aluminum prices on the London Metal Exchange peaked at $3,849 a tonne in March, but are now down more than 40 percent from their post-Russia-Ukraine conflict peaks.

Prices on the London Metal Exchange (LME) are down more than 40% from their March highs

High energy costs remain a threat to supply

Energy-intensive metals have been hit particularly hard by soaring energy costs in the wake of the Russia-Ukraine conflict, squeezing profits for producers. Aluminum is the light metal with the largest energy consumption, and the energy required to produce aluminum is about 40 times that of copper.

Since December 2021, major European smelters, including Alcoa’s St. Cyprian aluminum smelter and Hydro’s aluminum smelter in Slovakia, have implemented several production cuts.

As of mid-October, Europe and the United States have cut capacity by about 1.7 million tons combined from the second half of 2021, accounting for 25% of European production and 2.1% of global output.

The cut in Europe accounted for about 1.4 million tonnes of capacity. In the US, more than 300,000 tonnes of capacity has been cut, including at Alcoa’s Warrick aluminum smelter and Century Aluminum’s Hawesville aluminum smelter.

Despite the recent softness in energy prices, we do not expect capacity to resume in the short-term as Europe is heading into winter and the Russia-Ukraine conflict continues. Given the uncertainty over energy prices through next year, the likelihood of more aluminum smelter closures and production cuts is high. Any announcement of further shutdowns could send aluminum prices soaring, but any potential rebound is likely to be unsustainable. We do not expect European aluminum smelters to restart before 2024.

Global primary aluminum production rose 3.1% year-on-year to 5.85 million tonnes in October, despite continued production cuts in Europe and the United States, according to the International Aluminum Institute. China’s output was estimated at 3.475 million tonnes, according to the International Aluminum Institute.

Annualized global production totaled 68.9 million tonnes, according to the International Aluminum Institute. As for Chinese output, the International Aluminum Institute estimates an annualized output of 4.09 million tonnes in October.

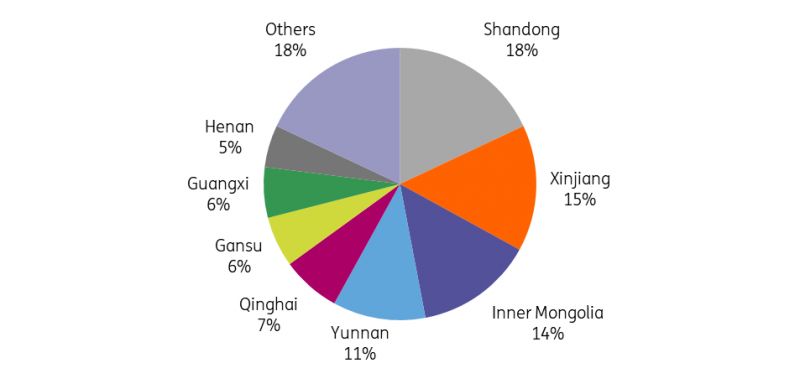

Aluminum smelters in China are also facing restrictions. In drought-affected Yunnan, which produces 11 percent of China’s aluminum output, the government ordered aluminum smelters to reduce operating rates from mid-September. Aluminum smelters in Yunnan have already cut about 20% of their operating capacity, or about 1.1 million tonnes a year. Due to current energy issues, idled capacity is unlikely to be restored before the end of this year, with restarts expected in the second quarter of 2023 once reservoir levels have stabilized.

This is the second consecutive year that Yunnan has reduced primary aluminum production. In 2021, Yunnan Aluminum’s smelters have experienced three rounds of large-scale production cuts in the face of power supply shortages, and aluminum smelting capacity has decreased by 1.74 million tons per year at an annual rate.

The cuts in Yunnan followed Sichuan aluminum smelters, which cut 920,000 tonnes of capacity in August, accounting for 2% of China’s total output. Most smelters in Sichuan have now restarted idled capacity.

Recently, some aluminum smelters in Henan province planned to cut capacity by around 10% due to winter-related cutbacks and operating losses, which could shut down 50,000-100,000 tonnes/year of capacity.

Still, despite the energy crisis, China’s aluminum production has remained steady. According to data from the National Bureau of Statistics of China, in the first 10 months of this year, China’s aluminum output was 33.33 million tons, an increase of 3.3% over the same period in 2021.

In the long run, as China continues to decarbonize the aluminum industry, increase the proportion of green energy generation, and shift production capacity from coal-based Shandong Province to hydropower-based Yunnan, green energy is heavily dependent on seasonality and Given the general weather conditions, the industry is vulnerable to further disruption.

Aluminum production capacity in various provinces in China

Demand dilemmas come into focus

The rise in global aluminum production comes at a time when demand has weakened due to a sluggish global economy.

The aluminum market’s focus has shifted to demand amid fears of a recession in Europe amid high electricity prices, central banks tightening monetary policy and China continuing to impose COVID-19 restrictions.

Industrial metals prices were hit by concerns over weakening global demand and a stronger dollar. Growing recession risks in the United States and Europe, as well as uncertainty about China’s recovery, are likely to continue to pose downside risks to the demand outlook.

In its latest World Economic Outlook, the International Monetary Fund lowered its forecast for global economic growth next year to 2.7 percent from 2.9 percent in July and 3.8 percent in January, adding that it expects global growth to slow to 2 percent next year. % chance of less than 25%.

About a third of the world’s economy is likely to contract next year, with the U.S., European Union and China all continuing to stagnate. Barring an unprecedented slowdown in 2020 due to the coronavirus pandemic, next year’s performance would be the weakest since the 2009 global financial crisis.

Aluminum consumption has been hit by a gloomy outlook for global economic growth, with world demand for primary aluminum excluding China expected to grow 0.4% year-on-year in 2022, according to CRU. According to CRU, no significant recovery is expected in 2023 as many economies battle recession, with demand expected to grow only 1.8% year-on-year in 2023. Demand in Europe will be hit the hardest in 2022 and is expected to be the main reason for weak growth in 2023.

In China, where demand stagnated in 2022 due to the zero covid policy and lockdown, CRU expects demand to grow by only 0.1% y/y around 4,000 tonnes in 2022, while the recovery in 2023 is expected to be slow due to a slowdown in the construction sector.

Russian metal remains biggest uncertainty

One potential source of price volatility is US or EU sanctions on Russian raw materials. Aluminum has largely escaped sanctions in the rounds of sanctions imposed on it following the Russia-Ukraine conflict, but the United States is reportedly considering an effective ban on imports of the metal from Russia. According to reports, the Biden administration is considering three potential measures, a comprehensive ban on imports of Russian aluminum, raising tariffs to a level equivalent to the ban, and sanctioning Rusal, which produces Russian aluminum.

So far, the only country that has taken direct action against the Rusal industry is the Australian government. In March, the Australian government banned exports of bauxite and alumina to Russia, effectively freezing Rusal’s take-up of business from its joint venture, Queensland Alumina. In Ukraine, Russia’s other major supplier of raw materials, the conflict has shut down Rusal’s Nikolaev alumina refinery. Chinese producers, who have filled the alumina gap, have been increasing exports to Russia.

However, if the US decides to sanction Rusal, the impact could be severe, bearing in mind the market reaction to the sanctions in 2018, when LME aluminum prices soared to $2,718 a tonne, the highest level since 2011, followed by a few weeks later. and a gradual decline over several months. Subsequently, the sanctions were lifted in January 2019.

If the U.S. decides to go ahead, the move could drive the Russian producer out of Western markets, depending on the severity of the sanctions, which would drive up global aluminum prices and distort global aluminum trade flows.

Meanwhile, at least for now, there has been increased transparency in the aluminum market following the LME’s decision not to act on Russian metals moving into LME warehouses, as a significant portion of the market is still planning to buy Russian metals in the next year.

The LME could consider banning Russian metals from its warehouses, restricting the flow of Russian metals, or taking no action.

Instead, the exchange said it would issue regular reports from January 2023 detailing the percentage of Russian metals in LME warehouses stored under guarantees to provide more transparency. In response to the LME proposal, Rusal has called on the LME to start disclosing the origin of all warrant metal stocks, rather than disclosing Russia separately as proposed. Alcoa also backed the idea of providing more details on the origin of raw materials for LME warehouses.

If we continue to see more and more self-sanctioning of Russian metals, the risk is that we will see more Russian metals being delivered to LME warehouses, which could mean that the LME trades at a lower price than it actually trades. However, the LME believes we will see more metal flowing into warehouses anyway, given the subdued global outlook.

The LME’s decision to continue allowing Russian metal into its warehouses has put some downward pressure on aluminum prices, alleviating concerns about supply shortages. How much further pressure aluminum prices will face going forward will depend on whether we see significant flows of Russian metal into LME warehouses in the weeks and months ahead.

While the LME acknowledges that LME prices may start to increasingly reflect the price of Russian metals if large amounts of money flow into LME warehouses, they argue that a premium will play an important role, which may reflect a larger proportion of the full cost, making the Non-Russian metal producers continue to receive fair value for their metals.

Russia accounts for 6% of global aluminum production of about 70 million tons this year. Rusal has accounted for three-quarters of LME inventories over the past decade, LME data show.

The proportion of Russian metal held in LME warehouses did not change significantly during the discussion paper period, the LME reported, with 17.7% of the live tonnage of Russian aluminum on warrants as of 28 October, compared with 17.7% when the LME published the discussion paper 17% on October 6.

Meanwhile, Russian metals flowed heavily into Western markets in the first half of the year. Average monthly European imports rose 13% year-on-year from March to June, while U.S. imports from Russia rose 21% over the same period.

Most of Rusal’s customers have been taking deliveries under existing contracts, but this could change next year. Self-sanctions are likely to disrupt trade flows as Russian metals risk flowing to the London Metal Exchange (LME) of last resort. Alcoa subsidiary Novelis and Norsk Hydro’s extrusion unit have said they will not sign new Russian procurement contracts in 2023.

Rusal recently said its sales had picked up following the LME’s decision, with primary and value-added production exceeding 76% in 2023.

Prices to decline in early 2023 due to poor near-term economic outlook

Looking ahead to the first quarter of 2023, the risk to aluminum prices will be mainly downside, with the continuation of the Russia-Ukraine conflict, rising energy prices, an insufficient supply of natural gas, high inflation, and weak downstream demand all exacerbating the pessimistic outlook for this light metal.

According to CRU, the aluminum market will significantly reduce the global deficit in 2022 and turn to a surplus in 2023, with a projected market deficit of 300,000 tons in 2022, down from 1.6 million tons in 2021. Taking production cuts into account, CRU expects only a modest surplus of 30,000 tonnes next year. This is driven by demand destruction in the world ex-China in 2022 and 2023 and higher domestic production in China than in 2021.

Excluding China, the estimated global surplus is only 71,000 tonnes. The reduction in demand will more than offset the closure of aluminum smelters in recent months.

In the short term, the focus of the market will remain on larger macroeconomic and demand side issues, with prices expected to fall further to $2,150/t in the first quarter of 2023.

In our view, aluminum prices should begin to recover in the second quarter of 2023, although any recovery will likely be slow.

ING's aluminum price forecast to 2023

LME Aluminium (US$/t)

1Q23 | 2Q23 | 3Q23 | 4Q23 | FY23 |

2150 | 2200 | 2300 | 2500 | 2290 |